How to Identify Top Injection Molding Services in China

Well, the major meeting has just concluded. your new product has been approved, time is pressing, and the budget is, let’s say, constrained.. Then someone—maybe your boss, maybe the finance director—utters the phrase that sends a little jolt down every project manager’s spine: “We should look at sourcing this from China.”

You nod, of course. It seems sensible at first glance. The potential savings can be massive. Yet your thoughts are already spinning. You’ve heard all the horror stories, right? The nightmare of defective parts, opaque communication, and delayed, off-spec shipments. It feels like walking a thin line between big savings and total project failure.

However, here’s the reality. Procuring plastic mold needn’t be a roll of the dice. It’s simply another project with clear steps. And its outcome hinges on the approach you take. It isn’t about the cheapest offer but about choosing the right supplier and running the process transparently. Ignore the nightmare anecdotes. Here’s a practical playbook to nail it.

Step One: Do Your Homework

Before you mention “supplier” or browse Alibaba, organize your internal data. In fact, most overseas manufacturing headaches stem from a vague or incomplete RFQ. Don’t assume a remote factory can guess your needs. It’s akin to asking someone to price-build “a structure” with no details. The replies will range from absurdly low to exorbitant, none of which help.

Your RFQ should be bulletproof—clear, detailed, and unambiguous. It’s the cornerstone of your entire effort.

So, what goes in it?

Begin with 3D CAD models. These are non-negotiable. Provide files in common formats (e.g., STEP, IGS) to prevent import issues. This is the master blueprint for your part’s geometry.

Yet 3D models don’t cover everything. You also need detailed 2D drawings. This details critical info missing from the 3D file. Examples include tolerances (e.g., ‘25.00±0.05 mm’), material grade, surface finish requirements, and functional callouts. If a specific surface needs to be perfectly smooth for a seal, or a particular hole diameter is vital for an assembly, your 2D drawing needs to shout it from the rooftops.

Next up, material. Don’t label it simply “Plastic.” Don’t even just say “ABS.” Be specific. If you need SABIC Cycolac MG38 in black, say exactly that. Why be exact? Because resin grades number in the thousands. Naming the precise grade locks in the mechanical, thermal, and aesthetic properties you need with plastic mold injection.

Your supplier might propose substitutes, but you must set the baseline.

Don’t forget the commercial info. What is your Estimated Annual Usage (EAU)? They need clarity: is it 1,000 total shots or a million units per annum? Tool style, cavity count, and unit cost are volume-driven.

The Great Supplier Hunt

Now that your RFQ is pristine. now, who do you send it to? The internet has made the world smaller, but it’s also made it a lot noisier. Locating vendors is easy; vetting them is the real challenge.

You’ll probably kick off on Alibaba or Made-in-China. These are great for casting a wide net and getting a feel for the landscape. Use them to build a shortlist, not the final list. Aim for a preliminary list of 10–15 potential partners.

But don’t stop there. Consider using a sourcing agent. Yes, they take a cut. But a reputable agent brings pre-screened factories. They bridge language and cultural gaps. On your first run, this is like insurance. It’s schedule protection.

Also consider trade fairs. If you have the travel budget, attending a major industry event like Chinaplas can be a game-changer. Nothing beats a face-to-face conversation. You can handle sample parts, meet the engineers, and get a gut feeling for a company in a way that emails just can’t match. And don’t forget the oldest trick in the book: referrals. Tap your professional contacts. Peer endorsements carry huge weight.

Sorting the Contenders from the Pretenders

After firing off that RFQ to a broad pool, the quotes will start trickling in. Some will be shockingly low, others surprisingly high. Now, sift through and shortlist 2–3 reliable candidates.

What’s the method? It’s a bit of an art and a science.

Begin with responsiveness. Do they respond quickly and clearly? Is their English good enough for complex technical discussions? But the key: do they probe your RFQ? A great supplier will review your RFQ and come back with thoughts. “Have you considered adding a draft angle here to improve ejection?” or “We see your tolerance requirement here; our CMM can verify that, but it will add to the inspection time. Is that acceptable?” That’s a huge positive sign. It shows they’re engaged and experienced. A “Sure, no issues” vendor often means trouble.

Then confirm their machinery specs. Get their tooling inventory. More importantly, ask for case studies of parts they’ve made that are similar to yours in size, complexity, or material. A small-gear shop won’t cut it for a big housing.

Finally, inspect the factory. Skipping this is a mistake. Just as you interview hires, audit suppliers. You can travel or outsource a local inspector. They’ll send a local inspector to the factory for a day. They authenticate the firm, review ISO credentials, evaluate machines, and survey operations. It’s the best few hundred dollars you will ever spend on your project.

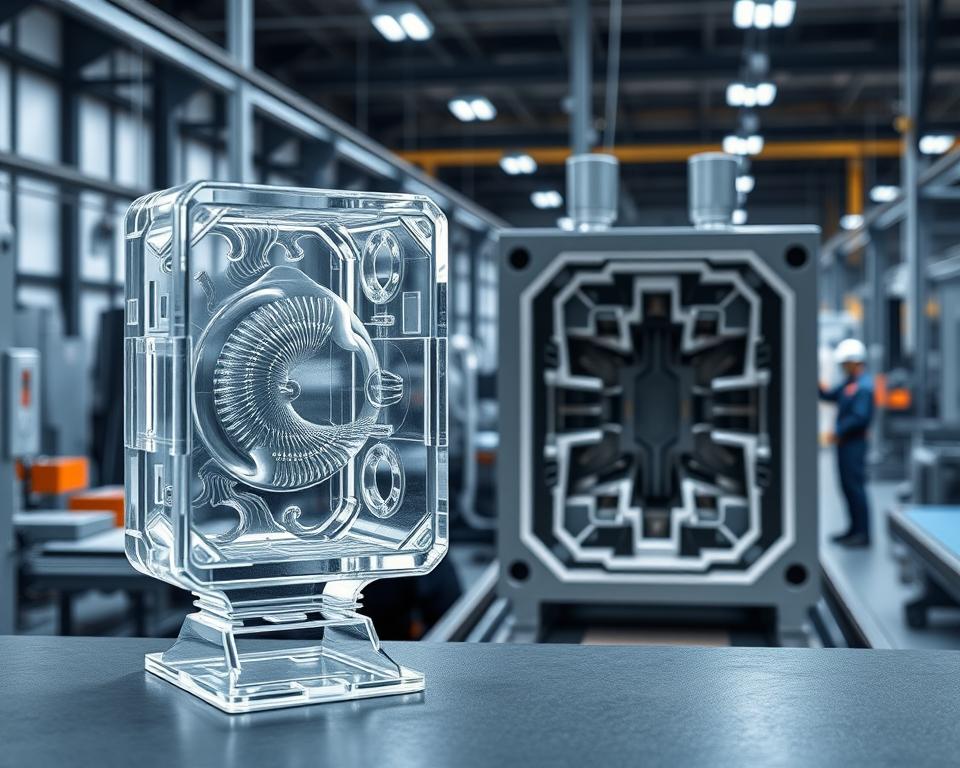

Converting Digital Designs into Molded Parts

You’ve selected your partner. you’ll agree on terms, typically 50% upfront for tooling and 50% upon first-sample approval. Now the real fun begins.

Your supplier’s first deliverable is a DFM analysis. DFM stands for Design for Manufacturability. This is your supplier’s formal feedback on your part design. The report calls out sink-risk zones, stress-causing corners, and draft angle gaps. Comprehensive DFM equals a top-tier supplier. It’s a collaboration. You work with their engineers to refine the design for optimal production.

With DFM sign-off, toolmaking begins. In a few weeks, you’ll see “T1 samples are on the way.” These are the very first parts off the new tool. It’s your test of success.

Expect T1s to need tweaks. It’s par for the course. There will be tiny imperfections, a dimension that’s slightly out of spec, or a blemish on the surface. You supply feedback, they tweak the tool, and T2 plastic mold in China samples follow. This process might take a couple of rounds. Plan for this loop in your schedule.

Finally, a flawless part arrives. Dimensions, finish, and performance all check out. This is now the benchmark sample. You formally approve it, and this sample is now the standard against which all future mass-produced parts will be judged.

Final Steps to Mass Production

Receiving the golden sample seems like victory, but you’re not done. Now comes full-scale production. How can you keep part #10,000 matching your golden sample?

Put a strong QC process in place. This often involves a pre-shipment inspection. Bring in an external QC firm. They’ll randomly select parts, compare them to specs and golden sample, and deliver a detailed report. You receive a full report with images and measurements. Once you sign off, you greenlight shipping and the last payment. This simple step prevents you from receiving a container full of scrap metal.

Finally, think about logistics. Understand the shipping terms, or Incoterms. Does FOB apply, passing risk at the ship’s rail? Or is it EXW (Ex Works), where you are responsible for picking it up from their factory door? Your Incoterm selection drives landed expenses.

China sourcing is a long-haul effort. It’s about building a relationship with your supplier. See them as collaborators, not vendors. Transparent dialogue, respect, and process discipline win. It’s a challenging project, no doubt. But with this framework, it’s one you can absolutely nail, delivering the cost savings everyone wants without sacrificing your sanity—or the quality of your product. You’re set to succeed.